Club deal market news.

Reports

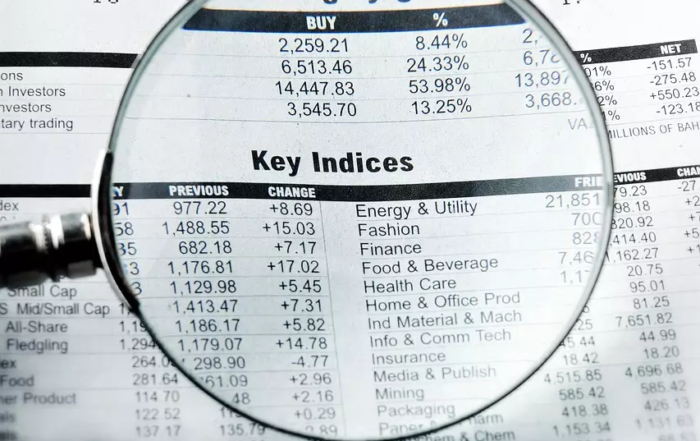

The ClubDeal Reports portal provides mission-critical intelligence on the global shift toward deal-by-deal co-investment. In an era of high capital costs, these reports track the “Hard Asset” rotation, highlighting how club deals have become the primary vehicle for massive industrial transitions in AI infrastructure, Net Zero energy, and hyperscale data centers.

By analyzing over $50 billion in quarterly transactions, our research identifies emerging trends such as “Internal Club Deals” and sovereign-led directs. This intelligence layer empowers Family Offices and institutional investors to move beyond cautious “wait-and-see” stances and execute high-conviction mandates with transparency.

Q1 2025 Global Club Deal Intelligence Report.

Q1 2025 marked a definitive break from the "wait-and-see" paralysis of 2024. The data reveals a market defined by bifurcation: while the middle market remained cautious due to tariff volatility (specifically the US-Mexico/Canada trade friction), the top end of the market exploded with activity driven by two distinct forces: AI Infrastructure and Sovereign Directs.

The ClubDeal benefits

Private members club connecting vetted Family Offices and institutional investors

ClubDeal.com is an exclusive club connecting vetted Family Offices to share intelligence, deals, and co-investment opportunities transparently.