“2 & 20” concentrates economics at the fund level (paid for delegated discretion across a portfolio), while deal‑by‑deal structures push economics down to each transaction (paid only when you opt in). When capital isn’t committed blind, fees become more negotiable, governance becomes more explicit, and “time‑based” fee drag is easier to see—and to reduce.

What “2 & 20” really buys

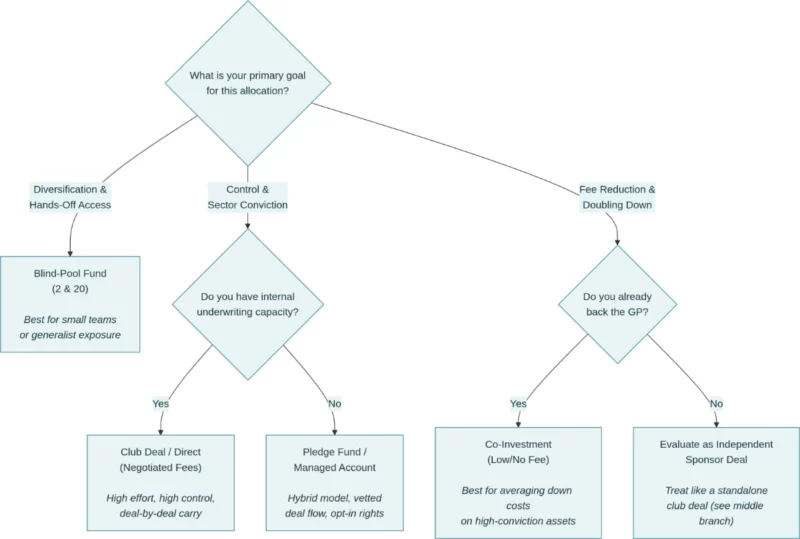

A classic private equity fund model charges an annual management fee (often ~2%) plus carried interest (often ~20%) on profits (hence “2 & 20”), in exchange for a blind‑pool commitment and full delegation to the GP. This structure supports a standing platform (team, sourcing engine, portfolio ops) and allows the GP to move fast without re‑raising capital for each deal. The trade‑off is limited selectivity: LPs can’t say “yes/no” per deal, and the fee stack runs regardless of which specific assets are acquired.

What changes in deal‑by‑deal

In deal‑by‑deal (club deals, SPV syndications, independent sponsors), investors usually decide transaction‑by‑transaction, so the “commitment premium” embedded in 2 & 20 declines. Fees often shift from fund‑level management fees to a mix of (i) lower ongoing monitoring/admin fees and (ii) explicit one‑off deal fees (transaction, structuring, financing). Carry/promote still exists, but it is commonly negotiated per deal and is easier to benchmark against the exact work, governance rights, and alignment being offered.

How fee drag shifts (the mechanics)

When you remove blind‑pool commitment, the economic debate usually moves from “manager selection” to “deal math and governance,” because each deal stands alone with its own fee stack and waterfall. Time becomes a first‑order variable: even small annual fees compound over long holds, so deal‑by‑deal investors tend to scrutinize fee base, fee caps, and offsets more aggressively. In the Fee Drag Visualizer example, a $1M investment over 8 years at 2.0x gross produces ~1.83x net under a fund‑like 2 & 20 stack versus ~1.91x net under a lighter “club 1&15” stack and ~1.95x under a low‑fee co‑invest style stack—illustrating how structure alone can move net multiples.

Concise case studies

| Case 1: Family office wants selectivity (deal‑by‑deal wins) |

|---|

| A family office with sector conviction reviews 8–12 opportunities/year and only invests in 2–3; it negotiates lower annual fees, clearer reporting, and reserved matters, effectively paying for underwriting and operating skill without paying for blind discretion. |

| Case 2: LP wants simplicity (fund wins) |

| A pension allocates to a mid‑market buyout fund because it values diversification and operational delegation more than deal‑level veto rights, accepting 2&20 as the “platform cost” of consistent sourcing and portfolio management. |

| Case 3: Relationship hybrid (co‑invest / lighter economics) |

| An institutional LP backs a GP’s flagship fund (2&20) for pipeline access, then targets incremental exposure via co‑invest sleeves with reduced fees/carry to lower blended fee drag on high‑conviction deals. |