In private markets, gross returns are only half the story. What matters is what lands in your account after management fees, deal fees, admin costs, and carried interest. This is fee drag: the silent gap between a deal’s “headline” performance and your net outcome.

ClubDeal.com offers you a free Excel spreadsheet model with detailed comparison scenarios and sensitivity analysis.

You’ll find the model below.

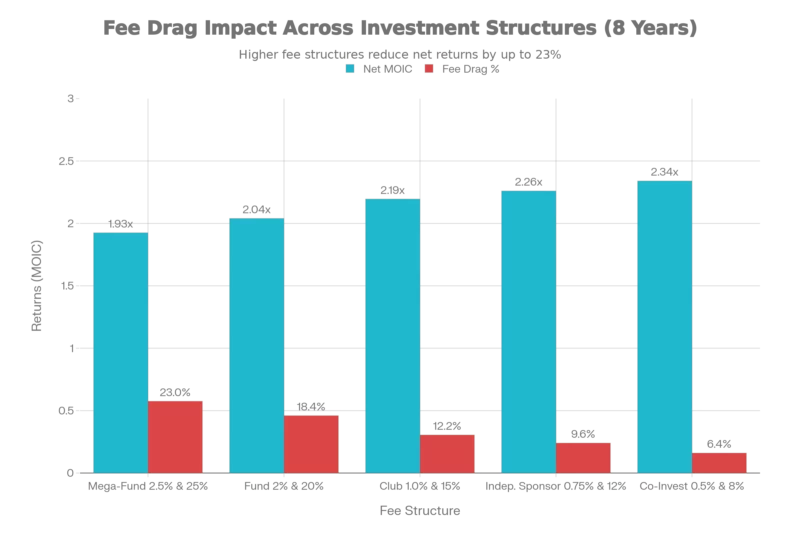

The Fee Drag Visualizer is a simple way to show (and quantify) how different fee stacks compound over time—especially when capital is locked up for 5–12 years.

What is “fee drag” (plain definition)

Fee drag is the reduction in your net multiple and net IRR caused by fees and expenses charged during the holding period and at exit.

A useful mental model is:

Why fee drag matters in club deals

In a club deal or co‑invest, you often invest to reduce the traditional “2 and 20” fee stack. But fee drag doesn’t disappear—it changes form:

-

Fewer “fund‑level” fees, but potentially more deal‑level fees (transaction, monitoring, SPV admin).

-

Better transparency, but more variance from sponsor to sponsor.

-

More control to negotiate—if you measure it correctly.

The 4 main fee buckets |

|---|

1) Ongoing fees (time‑based)These accrue with time, so long holds amplify their effect. Common examples:

Rule of thumb: time‑based fees are the easiest to underestimate because they “feel small” annually but compound over long durations. |

2) Transaction and one‑off fees (event‑based)These hit at specific moments: closing, refinancing, add‑on acquisitions, or exit. Common examples:

These reduce the amount of your capital that actually reaches the asset on day one. |

3) Performance fees (carry / promote)Carry is not “bad”—it’s an incentive. But it can materially reshape net outcomes. Common examples:

Carry only bites when the deal performs, but on winners it can be the largest single driver of fee drag. |

4) Friction and leakage (the hidden category)These are costs that don’t always show up as a clean “fee line” in marketing materials. Common examples:

|

A concrete example (why time matters)

Assume 3 structures deliver the same gross outcome: 2.0x over 8 years.

-

Structure A: Traditional fund = 2% annual fee + 20% carry

-

Structure B: Club Deal = 1 annual fee + 15% carry

-

Structure C: Club Deal co-invest = 0.5% annual fee + 10% carry

Even if you ignore nuances like fee base (committed vs invested), Structure A can easily lose an additional 0.15x–0.30x of net multiple over that duration—simply because annual fees compound with time and carry skims profits at exit.

The visualizer’s job is to make that “invisible” gap obvious in one glance.

Where this is most useful (use cases)

-

Comparing fund exposure vs club deal vs co‑invest for the same strategy

-

Stress‑testing whether a longer hold period still makes sense net of fees

-

Negotiating economics: “If we accept this transaction fee, we need fee offsets or a lower carry”

-

IC memos: presenting net outcomes, not marketing numbers

Key inputs you’ll need (so the math stays honest)

To keep the model practical, we’ll start with a clean set of inputs:

-

Investment amount (ticket size)

-

Holding period (years)

-

Gross outcome (either gross MOIC or gross IRR)

-

Annual fee rate and fee base assumption

-

Upfront fees (transaction/admin)

-

Carry rate, hurdle, and catch‑up (simple mode first, advanced later)

Then we’ll show the same deal under multiple fee stacks, side‑by‑side.

ClubDeal.com free Excel “Fee drag” spreadsheet model

With detailed comparison scenarios and sensitivity analysis.

How to interpret the result (quick rules)

-

If 2 opportunities have similar gross returns, the one with lower fee drag usually wins over long holds.

-

Small annual fee differences matter more than people think when time is long.

-

Carry differences matter most on winners—especially when there is no meaningful hurdle or when catch‑up is aggressive.

-

Deal fees matter most when entry valuations are tight and leverage is high (less margin for leakage).